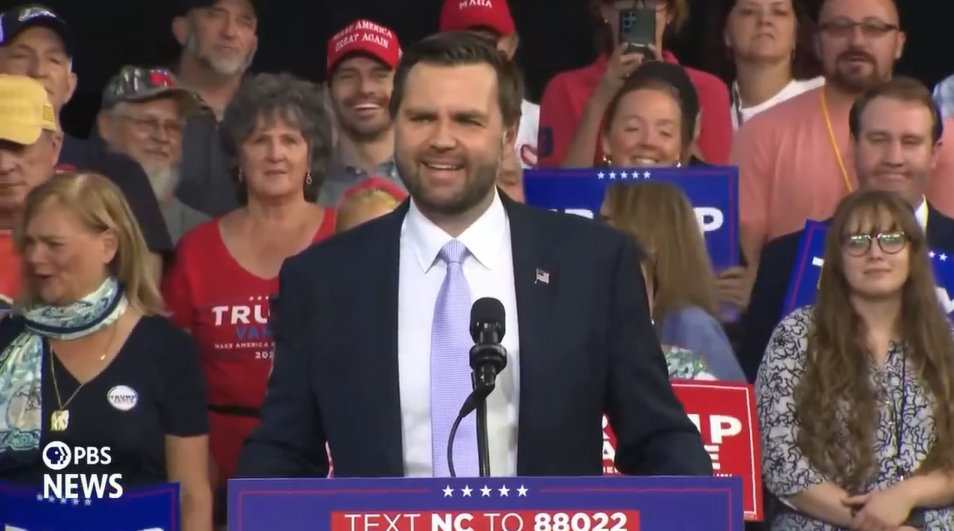

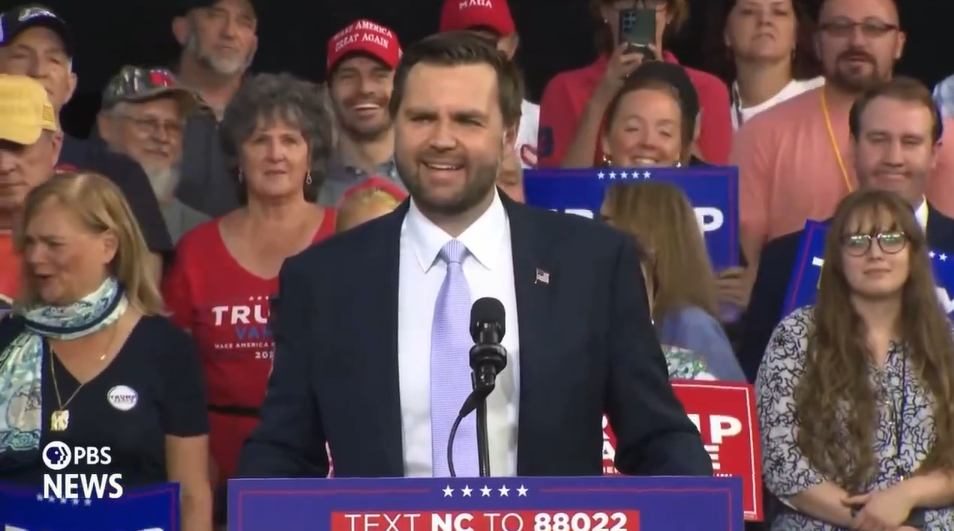

The crowd at JD Vance’s campaign rally in Raleigh, North Carolina on Wednesday booed after a reporter asked the vice presidential candidate for his reaction to the Fed cutting interest rates, which are “going to alleviate inflation for a lot of people.”

“Really quickly, just on the Fed cutting, it’s a very Wall Street Journally question, but the Fed cut the interest rate today by a half a percentage point, going to alleviate inflation for a lot of people. And so if you have any reaction to that?” asked the off-camera reporter.

The crowd loudly booed as Vance began to answer.

“Look my my my reaction is…” Vance said before waiting for the booing to end.

“My, my, my reaction is, a half a point is nothing compared to what American families have been dealing with for the last three years,” he replied to loud cheers from the crowd.

Pundits and economists have long looked for the Fed to cut interest rates as a sign that inflation was finally easing and the economic recovery from the pandemic was taking hold. “This will improve the material well-being of all Americans,” Joe Brusuelas, chief economist at RSM US, told the Washington Post after the rate cut. “We had three years of extremely aggressive policy out of the Fed. We’re now pivoting toward the normalization of rates in the post-pandemic economy.”

Former President Donald Trump has long painted a dire picture of the U.S. economy and instead of voicing praise for the record high stock market and energy production in recent months, has claimed a market crash is coming unless he is reelected.

CNN anchor Jake Tapper spoke to CNN Business anchor Julia Chatterley and asked how big the impact will be on everyday Americans.

“Huge and four-plus years in the making for borrowers. First, if you own a credit card, your rate on that card will adjust pretty quickly. The problem is the average rate on a new credit card right now is around 25%. So even with a big cut today, it’s sort of a rounding error on a rounding error and you might not notice the difference,” Chatterley began, adding:

For auto loans, for example. The hope is that this will now start to bring them down from incredibly high levels. But your rate that you’re offered depends on your credit history. It depends on what car you’re buying. So my advice on both of those things shop around. For mortgages, we’ve already seen mortgage rates coming down to around eight-month lows for 30 years.

This is good news today if you have an adjustable-rate mortgage. If you have a home equity line of credit because those rates will tick down. What it doesn’t help with is the overall level of high prices. That unfortunately is not affixed by interest rates. And finally, if you’re a saver, Jake, to your point, this is crucial, lock in high rates now before we see rates come down further. Certificates of deposit savings rate, if you’ve got the money invested.

Watch the clips above.

Have a tip for us? [email protected]