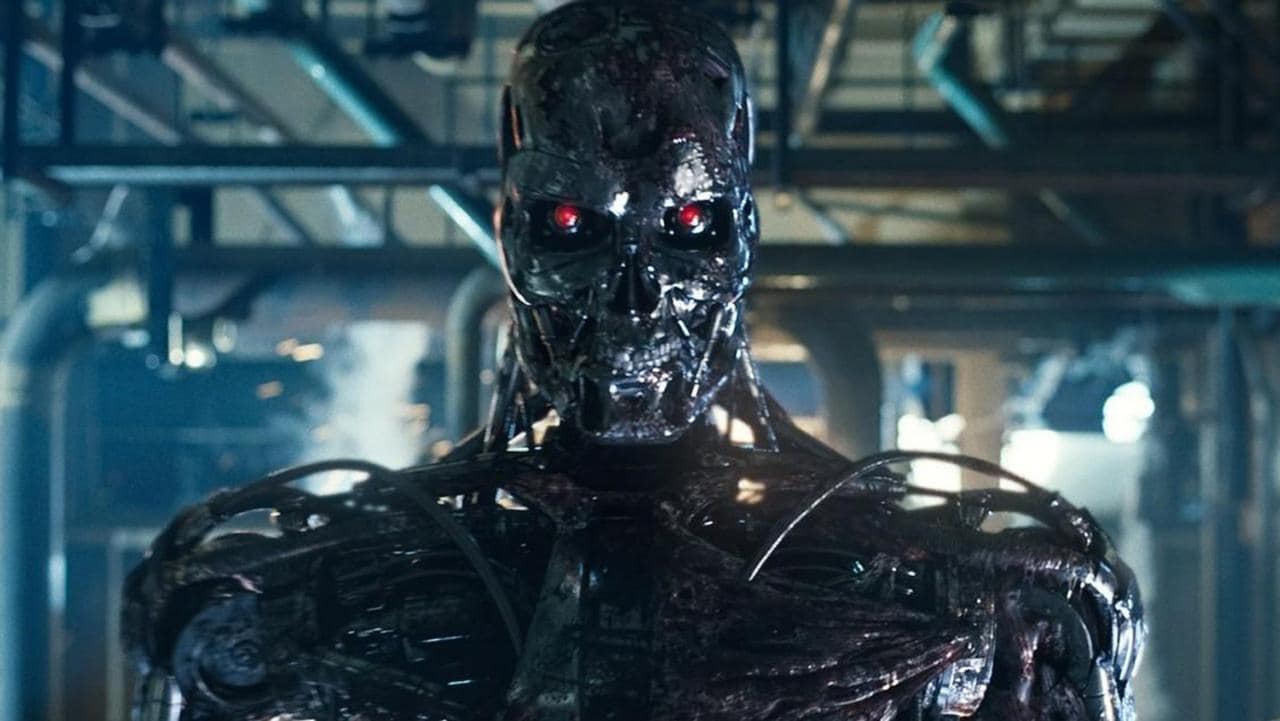

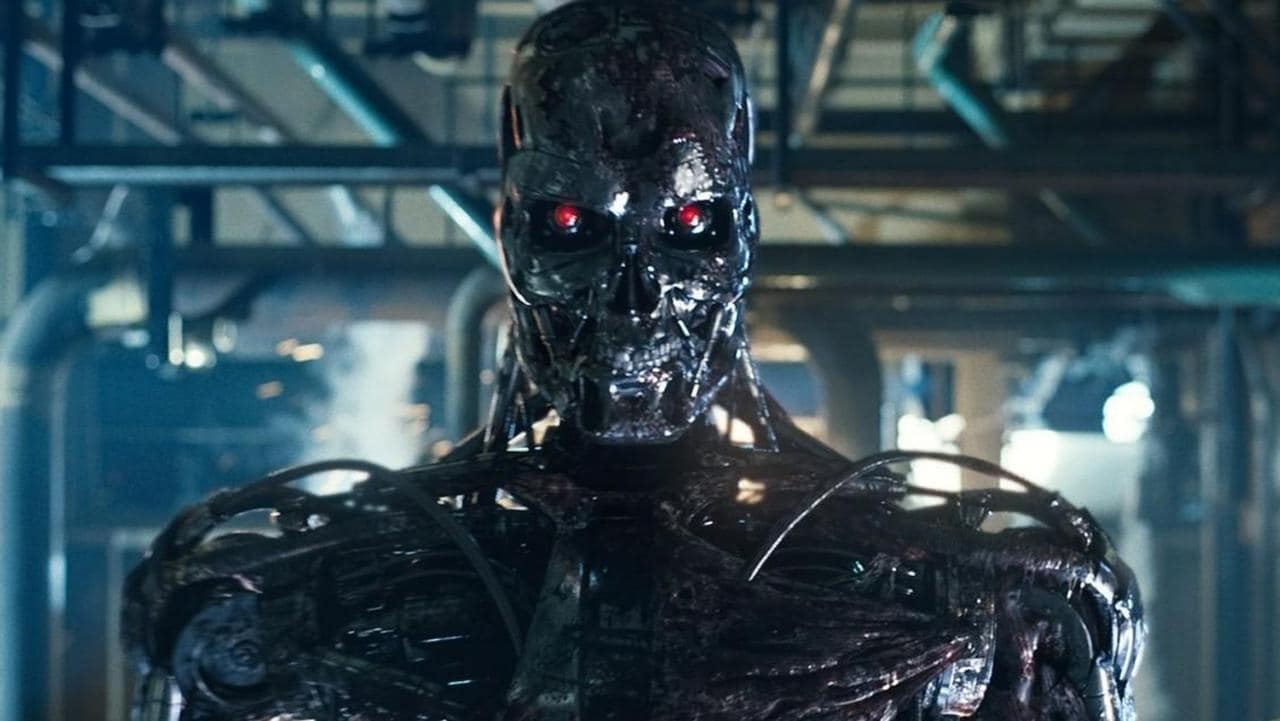

Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, we look at some economic effects of the A.I. revolution. (See the Economy & Finance section.)

Precious Metals:

From Kitco: Gold and silver’s next act – Matt Watson on precious metals and growing industrial demand.

o o o

Jordan Roy-Byrne, over at Gold-Eagle.com: Historical Comparisons for Gold Right Now.

Economy & Finance:

From Fortune: IMF official delivers stark warning on AI’s potential to turn an ordinary downturn into a severe economic crisis.

o o o

Is AI to Blame for All These Layoffs in 2024? The article begins:

“Despite a “booming economy” and soaring profits, tech companies like Google, Amazon, and Microsoft have laid off over 42,000 people so far in 2024, according to Yahoo Finance. However, it’s not only tech workers who are suddenly finding themselves out of a job. Business Insider reports that UPS will cut 12,000 jobs in 2024, including 14% of the company’s 8,500 managers. Then there are companies like Expedia, Wayfair, Tesla, and Nike, all of whom have seen notable cuts to their workforce in 2024.“

o o o

Harvard Business Review: AI’s Trust Problem.

o o o

Over at the Whatfinger.com: Apple Rejects Meta Partnership, Embraces OpenAI and Other AI Innovators for iPhone Integration.

Derivatives:

Reader D.S.V. sent this: Goldman Sachs’ Bank Derivatives Have Grown from $40 Trillion to $54 Trillion in Five Years; So How Did Its Credit Exposure Improve by 200 Percent?

o o o

Another interesting article from Wall Street on Parade: The Fed and FDIC Wake Up Suddenly to the Threat of Derivatives, Flunking the Four Largest Derivative Banks on their Wind-Down Plans.

o o o

o o o

Comptroller’s 1Q Report: Quarterly Report on Bank Trading and Derivatives Activities.

Inflation/Deflation Watch:

Interestingly, this was reported by the liberal/statist CNN: Fact check: Biden again falsely claims inflation was 9% when he became president.

o o o

Fact Check: Karine Jean-Pierre Claims Grocery Prices Went Down Under Biden.

o o o

At Politico: Biden’s economy: Good metrics, bad vibes, few levers.

o o o

Reported last month: Are ammo prices dropping?

o o o

David Haggith: Inflation Keeps Coming in Waves, but Economist Can’t Even Get on their Surfboards.

Forex & Cryptos:

Swiss National Bank Cuts Key Interest Rate Amid Mixed Global Monetary Outlook.

o o o

At Currency Thoughts: Japanese Yen Retreats to 34-Year Low of 160.4 Per Dollar.

o o o

From the leftist NPR: A strong dollar is great news for most of us — but not everybody is a winner.

o o o

At Binance: Bitcoin Price Analysis for June 2024.

o o o

MiCA: The Impacts on the EU Stablecoin Industry.

Tangibles Investing:

An interesting video that recommends an unconventional tangible investment: Don’t Miss Out! 10 Reasons to Buy CDs Now Before it’s Too Late.

o o o

US New Home Sales Crashed In May.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. Thanks!